×

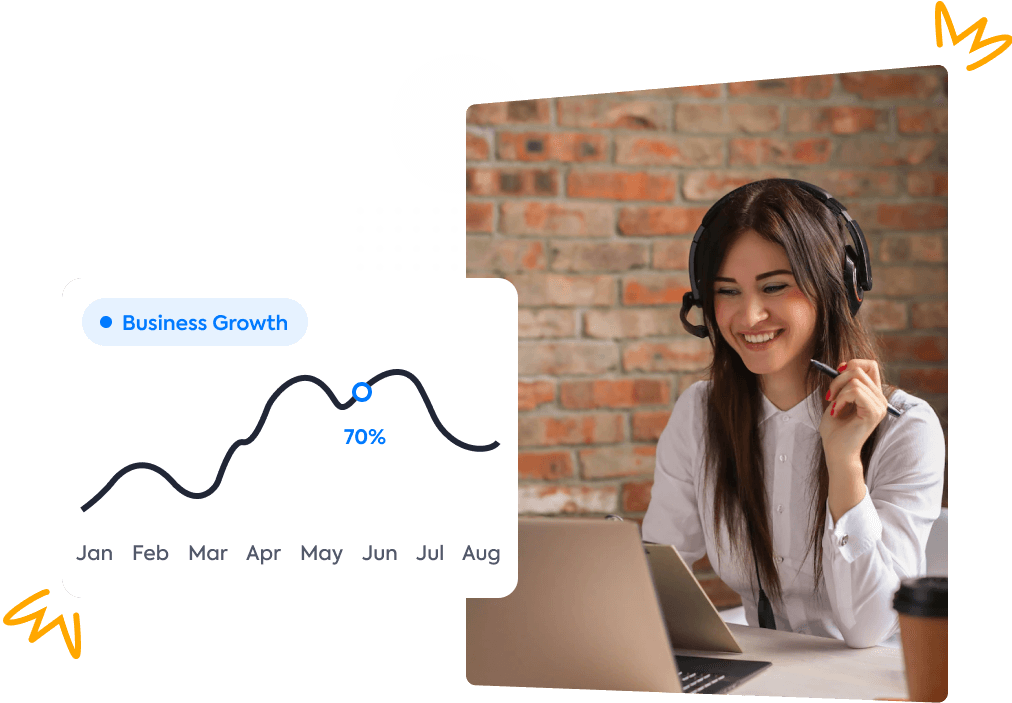

Streamline business processes with Superworks

Get started with a free trial!

Sign up & let’s start

Easy to set up

Seamless configuration

All in one platform for hassle-free processes

30 days free trial

Quick customer support

Anytime withdrawal

Trusted by more than 15 brands

Reliable solutions

Transparent pricing

No direct payment required

Loved by customers across 30+ cities

Book a free demo

Talk to our expert and know how it will work in your system

Contact Sales

Contact Sales